Stock Split

|

| Learn About Stock Split |

We have heard and seen about several stocks with price in 5 digits.

What do you think, isn't it possible for every stock market participants to buy such huge price stocks?

So, what do you think now what stock market participants should do? Shall they should buy this stocks or leave it.

But if this stock is in 5 digits means this stock having solid fundamentals and growth trajectory.

Now the situation in not balance, stock is good but not affordable for all. Several times such situation comes in stock market in many stocks.

This situation can be balanced and can be overcome by different techniques and one of this technique is stock split.

Suppose your friend having $10000 and he want to buy a share of price $10000, then he can buy 1 share of it. And now you are having $2000 in your pocket but you also want to buy same share of price $10000, then isn't it possible.

But now company had decided to split their shares into 10 for 1, that means now the share price is $1000/each. Means now your friend can buy 10 shares in $10000 with new share price $1000 and you can also buy 2 shares with your $2000.

What is Stock Split?

Split means breaking, when a firm declares a stock split, the number of shares issued increases, but the market capitalization remains unchanged. Existing shares get splits, but the underlying value is unchanged. The price per share falls as the number of shares grows.

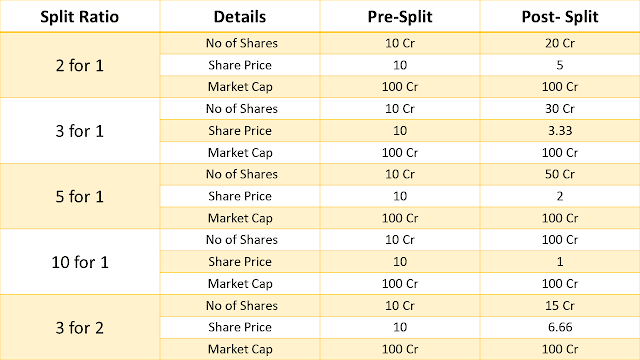

There are various ratios in which company board splits their shares e.g.

2 for 1

3 for 1

5 for 1

10 for 1

3 for 2 like that,

|

| Split Ratio's |

Why company do stock splits?

A stock split is considered by corporations for variety of reasons. The first explanation has to do with psychology. As the price of a stock rises, some investors may believe it is too expensive to purchase, while small investors my believe it is unaffordable. Splitting the stock lowers the price of the stock to a more appealing level. While the stock's true value remains unchanged, the decreased stock price may have an impact on how the stock is viewed, perhaps attracting new investors. Existing shareholder will also feel as though they have more shares than they had before the stock was split, and they will have more stock to trade if the price rises.

Any advantage of stock split to investor?

There are many debates on whether stock splits benefit or harm investors. A stock split, according to one side, is a good buying indicator, indicating that the company's share price is rising and performing well. While this is true, a stock split has no influence on the stocks underlying value and provides no actual benefit to investors. Despite this, investing newsletters usually pay attention to the generally favorable sentiment surrounding a stock split. There are entire magazines dedicated to following split equities and attempting to profit from the positive nature of splits. Critics argue that this technique isn't tried and true, and is only marginally successful.

Conclusion

It's time to wrap-up, the major motive for purchasing a company's stock should not be due to a stock split. While there are some psychological motivations for corporations splitting their stock, none of the business fundamentals are affected. Remember that the split has no impact on the company's market capitalization.

Disclaimer: This article is only for knowledge and information sharing purpose and not for any type of recommendation or promotion of anything to anyone.

Don't Forget to LIKE, FOLLOW, SUBSCRIBE & SHARE with your Friend's & Family.

For Shopping & Deals You Can Visit : https://bestchoice4every1.blogspot.com/

0 Comments

Please do not enter any spam in the comment box.