Growth Speed Limit of Our Investment, Related to Risk & Reward

|

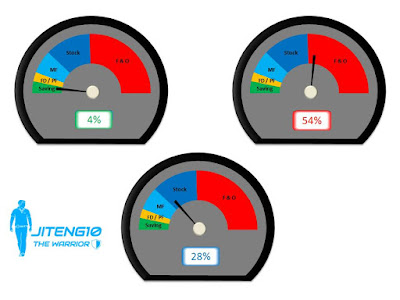

| Investment Speed-O-Meter |

Welcome Friends,

Today again we all come back to enjoy and discuss one more topic " Height of Return with Depth of Risk".

You all are very intelligent as upto now you have already understood that the today's topic is related to Risk and Return for the Topic Heading.

Right Friends.

Today we will talk about Risk and Reward ie Return.

Introduction:

Risk and Reward is very important aspect and part of any type of our investment.As everybody says, the more you take Risk, the more you get the Reward.

But there are several factors which impacts our Risk taking capability and so confined our Reward opportunity.

For Shopping & Deals Click Below:

What are the factors which impact our Risk taking capability?

There are several factors related to our Risk taking capability which impacts us but few of them are- Our income amount

- Our knowledge about risk

- Our group circle

- Our psychology etc...

What are category of Risk taker?

Mainly there are there types of Risk takers:- Conservative

- Moderate

- Aggressive

What are the category wise working zone of Risk takers?

Working zones of Risk takers are:- Safe zone

- Average zone

- Aggressive zone

Based on our Risk taking capability, category of Risk taking & working zone we define our Reward Opportunity.

For this we have to understand the relation of Height of Reward with Depth of Risk.

Height of Reward with Depth of Risk:

Below image make your view more clear related to Height of Reward with Depth of Risk. |

| Source: Clipart | Investment Zones |

Example to understand Height of Reward and Depth of Risk:

Let's under this Height of Reward and Depth of Risk with an example swimming pool diver.

There are 3 zones in swimming pool according to height of diving platform as below:

As safe zone, average zone and aggressive zone.

Safe Zone:

In safe zone the new comer or the less confident public use to learn and dive in swimming pool.As this zone is safe and heaving less height and hence no chance of getting hurt or drowning.

Similar way in investment also the conservative or less confident public (Diver A & Diver B) put or invest their money in saving a/c or FD & PF.

As this zone is safe and having less risk of money drowning but the impact is visible on their Reward.

As their investment is safe but earning get locks between

3% - 5% in saving a/c, means on 1 Lakh return is Rs.3000 to Rs.5000 in 1 yr.

7% - 9% in FD & PF, means on 1 Lakh return is Rs.7000 to Rs.9000 in 1 yr.

|

| Source: Clipart |

Average Zone:

In this zone the diving platform is at average height and public having little bit of confidence and having very little swimming experience, but can dive with the help of some expert diver. Platform height is somewhat more than safe zone but less than aggressive zone. Height is more and chance of hurting is also there but average range.Similar way in investment also the moderate or little bit confidence public (Diver C) put or invest their money in MF with the help of expert Fund Manager and Fund Advisory.

As this zone is average and having average risk of money drowning but the impact is visible on their Reward.

As their investment is averagely safe and earning get locks between

12% - 20% in MF.

Aggressive Zone:

In this zone the diving platform is at very high level and public having well experienced can survive here only. No one help any one here you have to work hard for yourself.

Similar way in investment also the aggressive or experienced public (Diver D & Diver E) put or invest their money in Stocks and F&O with their own experience.

As this zone is aggressive and having high risk of money drowning but the impact is also visible on their Reward.

As their investment is risky and earning having no boundary limit, sky is totally open to generate return.

+25% return possible in Stocks

+50% return possible in F&O

+50% return possible in F&O

For the above discussion till now you are quit clear that, as the height of diving platform is increasing more and more then the risk is also increasing from hurting, injury to drowning, if not handle properly.

So in investment also as the Height of Reward is increasing from 3%, 7%, 12%, +25% and +50% then the Depth of Risk is also increasing from safe return, average return to unsafe return or even zero return ie total loss.

Conclusion:

As Risk and Reward are directly associated with each other. As the Risk increase so the Reward is also going to increase.

- Saving a/c less risk and less return.

- FD & PF less risk and less return

- MF moderate risk and moderate return

- Stocks high risk and high return

- F&O very high risk and very high return.

Very crystal clear picture, choose your limit of return ( Safe / Average / Aggressive ) you want, don't be greedy if you can't handle the risk part and accordingly invest in the instrument ( Saving & FD/PF / .MF / Stocks & F&O) as per your ability.

So, Friends Good Bye for now. All the Best!

You Should also read :

1. Strong Cushion to Portfolio by Hedging - Click here!

2. Balance and Manage Risk and Reward - Click here!

So, Friends Good Bye for now. All the Best!

You Should also read :

1. Strong Cushion to Portfolio by Hedging - Click here!

2. Balance and Manage Risk and Reward - Click here!

Disclaimer: This article is only for knowledge and information sharing and not for any type of recommendation for invest. Do your own analysis before investment.

Friend's Don't Forget to LIKE, FOLLOW, SHARE & SUBSCRIBE......

For Shopping & Deals Visit : https://bestchoice4every1.blogspot.com/

6 Comments

A precisely well described session on types of saving and investment.

ReplyDeleteSir, how F&O gives upto 50% of return?

DeleteWell Explained, Can we have mixed level of Risk Management, Is there is any thumb rule to have distribution in all category.

ReplyDelete-Picture & illustration should be on same screen would have added more weightage..

Yes and nice concept as I will share my own experiences about my aggressive approch that as I had purchase share of idea vodaphone of Rs3.35/share in last week of march2020 and now today its price is Rs5.55w/shareis almost double so fact is that once should take risk will gain more.

ReplyDeleteVery much informative for self development

ReplyDeleteCategorization is very informative 👍

ReplyDeletePlease do not enter any spam in the comment box.