Financial Planning Pyramid? & its Importance?

|

| source: clipart |

This is the very famous Law by a very famous Scientist.

Here if we see this words in term of finance than if we have income, than only we can spend or invest. Or for Spending or Investment we need income.

|

| source: clipart |

And base of any financial activity in our life is our income and after retirement the wealth we created by investment is the only source of our income. So, proper planning of wealth creation is very very important.

|

| source: clipart |

Our income defines our life style, our spending, our investment, liberty of our thought process (eg - if we have good income we take fast decisions on financial matters without compromise. But if we have average income than still, we can live but with several binding on financial decisions).

|

| source: clipart |

Although income amount, is very subjective matter but very important and like wise expenditure and investment is also a subjective matter. But there is common structure under which we have to align all of them for proper and smooth running of our life with earning now and after retirement.

For that we have to understand the term Financial Planning Pyramid

Let's go and crack it......

For Shopping & Deals Click Below :

What is Financial Planning Pyramid?

There are few fact of our life which we can't ignore or we can't run away from them.These are the main hindrance factor between our investment and wealth creation.

Few of them are

- Shortage of funds for investment or fear of being jobless.

- Death is the ultimate truth and we can't ignore it. And what happen if the single earning person dies.

- Health problem of ours and our family members.

- Different uncertainties in day to day life. (today corona Pandemic) and in future may be some other thing.

|

| source: clipart |

These are the few leakages between our income and investment for wealth creation, which we are ignoring knowingly or unaware of those things factors. And which pull us back and not let us to reach or divert us from our financial targets or may cause delay in reaching to our financial targets.

This are the few important bitter truth which move around us and we don't have answer for all this uncertainties.

So, we have to get ready to face this situation and prepare our self ready to answer to all these questions. But this preparation is not possible in single day. You just wake up in the morning and decided during breakfast that from today I will do my preparation for getting ready to face this uncertainty situations. No not possible. We need to have proper step wise plan and have to align our plan.

|

| source: clipart |

Now here come into picture the term Financial Planning.

And the systematic structured procedure followed step wise is known as the Financial Planning Pyramid.

Let's go and see what are the steps or how many levels are there in Financial Planning Pyramid.

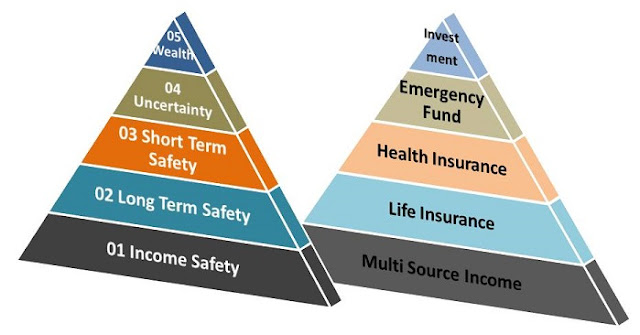

How many levels are there in Financial Planning Pyramid?

There are in all 5 levels in the Financial Planning Pyramid.:1. Financial Planning Pyramid Level 1

Target - Income Safety

Action - Multi Source Income:

This is the first and the base or the foundation of Financial Planning Pyramid and it need to be very solid and stable. If income or earning source totally failed then the whole Pyramid will collapse.

|

| source: clipart |

But now a days competition is more and earning are getting diminishing and expenditure burden are increasing. And in addition to this there is no security and surety of jobs. Hence looking at present scenario, we should learn and develop and go for multi source for income or earning.

|

| source: clipart |

2. Financial Planning Pyramid Level 2

Target - Long Term Safety (for our Family)

Action - Term Plan:

This is the second phase of Pyramid structure and is not for you but for your family safety. As we are aware that we are the only income generating person of your family and no other source available for income without you. And just for a movement think if unfortunately something happens with us and we are no more. Sorry, but no one's family should have to face such situation. In this situation what our family will do. How will they survive further life. So it is our responsibility to make arrangement for their livelihood when we are here and also when we are not here. |

| source: clipart |

I don't want to elaborate this ugly situation further more, you are very well aware of all this things what you have seen in others life infront of you.

My intention is not to make you afraid but make you aware for such mishaps of life.

For this the income generating person should have a sufficient amount of life insurance ie Term Plan.

But the question is that "How much amount life insurance should we have?"

As a thumb rule the insurance amount should generate income equivalent to today's family expenditure / month. If today's family expenditure amount is Rs 50000 / month. Then Term plan of income generating person should be such that, if total amount deposited in bank and the interest earn from the bank on this total deposited amount in saving a/c is atleast Rs 50000 / month. It is very clear rule. So that no family member will have to work or raise hand infront of any other person and atleast they can live their life comfortably further.

3. Financial Planning Pyramid Level 3

Target - Short Term Safety

Action - Health Plan:

This is third phase of pyramid and it also makes major leakage in our journey of wealth creation. Life is totally full of several ups and downs and problems. And now making us prone to new types of different diseases. And if by chance we get attacked by any one of such disease then, we have started moving out money from our accumulated wealth which cause huge huge leakage in our wealth creation plan. And we get diverted from our path of wealth creation because we have face bad situation now and we forgot or we keep one side our future target of wealth creation. But we have to tackle such situation smartly. We should have to be ready by taking family floater Health insurances for such situation. In which this type of medical emergencies are taken care by the Health insurance plan and our wealth creation journey will continue without any brake. |

| source: clipart |

4. Financial Planning Pyramid Level 4

Target - Uncertainty Situations

Action - Emergency Fund:

This is forth phase of pyramid and this situation come in our day to day life now and then. Like today when I am writing on this topic, we are facing as world wide pandemic - corona. Now total country is under lockdown and several have lost there jobs. But as an when situation change all of them will get job back and life is back on track. But for this moment now we should have some amount kept safely as contingency backup or emergency fund for atleast next 6 months as per our monthly expenditure. Otherwise our total life and investment structure get disturbed. And we will loose our momentum of wealth creation. |

| source: clipart |

5. Financial Planning Pyramid Level 5

Target - Wealth Creation

Action - Investment:

This is the fifth and the last phase or top most phase of pyramid. Till now we have worked on previous 4 level to protect this 5 level. we should go for this stage or level only if we have fully covered the previous 4 phases of pyramid. Now we can go for wealth creation by investment in different investment instruments like Equity, Mutual Funds, PPF, Bonds, Gold etc as per our targeted planned return and our risk taking ability. |

| source: clipart |

So far you have under gone all the 5 levels of Financial Planning Pyramid and got clear cut idea how to go for wealth creation journey form income to investment step wise.

But now question is that why this step wise process is important.

For Shopping & Deals Click Below:

What is the importance of Financial Planning Pyramid?

As you have seen in our above discussion that for investment we need money and money is generated by our income source (job/business etc). If we go directly for investment without planning of pit hole in the way of successful investment and returns, then we will not get desired return or result because surely we will going to get trapped in any of that 4 bottom level problem of pyramid.

- Income safety

- Long term safety

- Short term safety

- Uncertainty

To understand and work out on these levels of Financial Planning Pyramid on priority basis one by one in systematic way to avoid trapping in pit-hole and to achieve the desired result, it is important to follow the Financial Planning Pyramid steps and make proper arrangement of them. So, if we have to face such situation than we are already planned for that problem in advance and will continue of wealth creation journey.

Conclusion :

Wealth creation is must for everyone now a days. As incomes are limited and Goals as well as Responsibilities are more. Wealth creation help us to achieve our targeted goals. But wealth creation goal itself is not possible without proper systematic approach to avoid leakages and hindrances in a way of wealth creation. And the Financial Planning Pyramid do this part for us by properly guiding us what to do first and then next and then next. And cover all the pit-hole in why of our investment and return.So, Friend hope you have enjoyed this article. Good Bye and All the Best !

Disclaimer: This article is only for knowledge and information sharing and not for any type of promotion or recommendation of any company or plan.

Friend's Don't Forget to LIKE, FOLLOW, SHARE & SUBSCRIBE......

For Shopping & Deals Visit : https://bestchoice4every1.blogspot.com/

6 Comments

Educative 👏

ReplyDeleteDo we really plan for uncertain situations, If yes how much amount we have to keep in Hand... and how much chances of there that this much amount we keep forever, because human tendency is that we some one has amount in Hand, he may sweep out it in any way...Your comments plz..

ReplyDeleteEmergency Fund (EF) is must for everybody. Atleast 3 ~ 6 Month EF for uncertainty is required to avoid disturbance during unfavorable situations. It is Disciplinary part if u want safety to your portfolio than you have to be strict. During unfavorable condition ur Portfolio is also in very big loss and to move out money from there is double loss. Pls plan of EF.

DeleteI enjoyed the whole article

ReplyDeleteA very thoughtful article...This is truly in line with... The great Maslow heirarchy of needs....This is HEIRARCHY OF FINANCIAL PLANNING needs.,.

ReplyDeleteInteresting read,. Heirarchy of Financial needs explained in a very simple way....

ReplyDeletePlease do not enter any spam in the comment box.