EBITDA - Earning Before + Interest + Taxes + Depreciation + Amortization

Get Connect to : themarketwarrior

|

| EBITDA |

If you are working in stock market then several times you have heard about the term EBITDA wherever there is Quarterly results or Annually results announced by company.

Full form of EBITDA - Earning Before + Interest + Taxes + Depreciation + Amortization. The full form its explains what is included in EBITDA. It is the profit of company before paying portion of Interest, Taxes, Depreciation and Amortization. EBITDA details founds in the Profit & Loss statement.

Earning - Amount generated by sales.

Interest - Amount paid in the form of monetary charge for loans taken.

Tax - Amount paid in the form of taxes levied by government.

Depreciation - Amount paid for the expensing of a fixed tangible assets over it useful life. Ex - Equipment, Vehicle, Land, Machinery & Building etc.

Amortization - Amount paid for the intangible assets over the asset's useful life. Ex - Patents, Trademarks, Franchise agreements, Proprietary processes (Copyrights) etc.

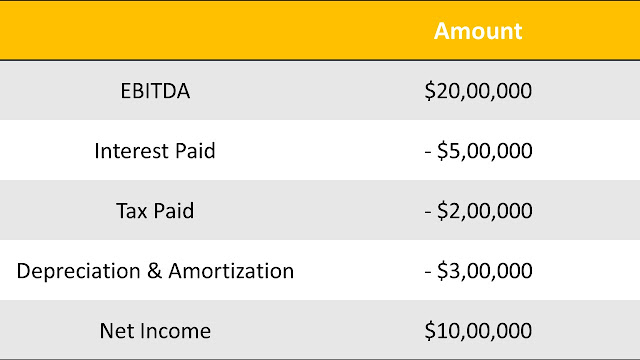

How to Calculate EBITDA?

EBITDA = Net Income + Interest + Tax + Depreciation + Amortization

It's time to wrap up. So, EBITDA is now easily understandable to you as it is the profit of company before paying of Interest, Taxes, Depreciation and Amortization.

Disclaimer: This article is only for knowledge and information sharing purpose and not for any type of recommendation or promotion of anything or any website to anyone.

Don't Forget to LIKE, FOLLOW, SUBSCRIBE & SHARE with your Friend's & Family.

For Shopping & Deals You Can Visit : https://bestchoice4every1.blogspot.com

0 Comments

Please do not enter any spam in the comment box.