|

| Emergency Fund |

|

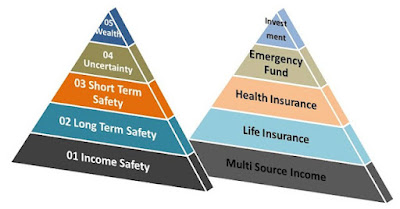

| 5 Level Financial Planning Pyramid |

What is an emergency fund?

The emergency fund is the fourth level of the financial planning pyramid, as shown in the diagram above. It protects our financial planning against the unknown that enters our lives without warning. The goal of an emergency fund is to provide financial stability by providing a safety net that may be utilized to cover unexpected expenses like medical emergency or job loss for short duration of time and available easily in short time.

In general, the emergency fund amount should have to be sufficient enough to cover all of our basic needs for the following six months if we experience a misfortune such as a job loss or a medical issue and are unable to work.

If our monthly demand is $30,000, we should keep at least $30,000 * 6 months = $1,50,000, in liquid form in our account, which is conveniently available in the event of an emergency.

Or as an alternatively, you can keep at least 20% ($30,000) of your liquid emergency fund on hand at all times in your house.

We must concentrate on the accumulation of emergency fund first after finishing financial planning pyramid levels 2 and 3.

For example,

If your monthly salary is $50,000, any money left over after paying your monthly expenses, health insurance premiums, and term insurance premiums should be used to build up your emergency fund first.

Emergency fund is very important element of your financial pyramid. Before going for starting your investment journey, you should first accumulate sufficient required emergency fund. So that in case of any mishap, you can balance you financial responsibilities without getting disturb yourself and your financial plans.

Disclaimer: This article is only for knowledge and information sharing purpose and not for any type of recommendation or promotion of anything or any website to anyone.

Don't Forget to LIKE, FOLLOW, SUBSCRIBE & SHARE with your Friend's & Family.

0 Comments

Please do not enter any spam in the comment box.